What are these famous Scope 3 activities and which ones are relevant for my company?

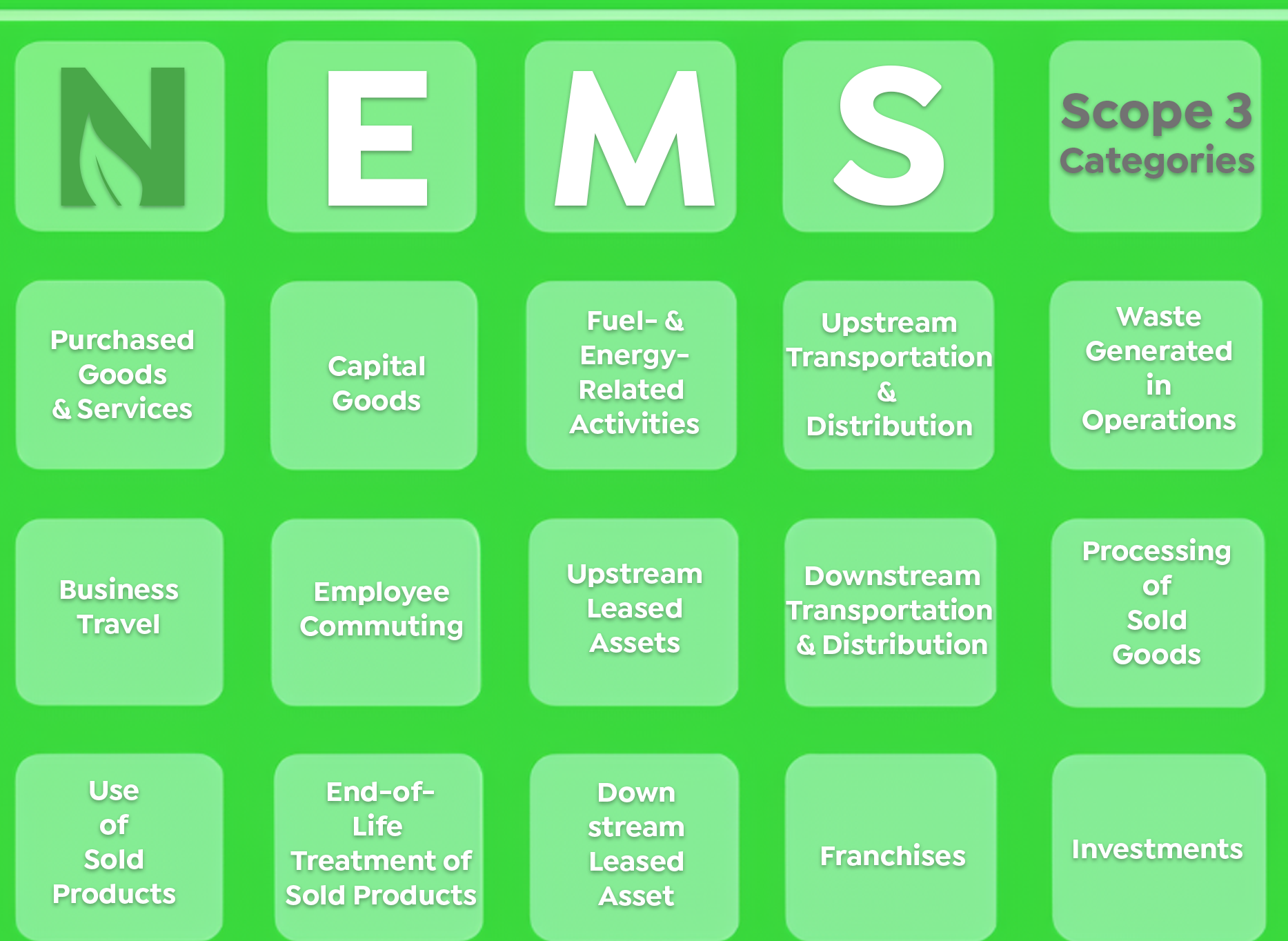

Once the organizational boundary is decided it is time to identify which Scope 3 activities to include in the Scope 3 inventory. But what are those Scope 3 activities and how do we know which ones are relevant for our Scope 3 study?

Broadly speaking, Scope 3 activities are defined as activities that occur in entities and assets owned or controlled by other players in the value chain, such as suppliers, customers, employees, transport providers and similar. The Scope 3 standard divides emissions into two main groups depending on the direction of financial transactions; upstream and downstream emissions. Upstream emissions are emissions that is related to purchased goods and services and occur up to the point of recipient of the company while downstream emissions are emissions related to sold product and services and occur after the product is sold and leaves the company premises. Emissions that occur inside the company (where the company has ownership or control) are direct emissions and cannot be classified either as upstream or downstream emissions.

The first step in identifying these activities is to review the 15 Scope 3 categories. The Scope 3 standard provides well-organized definitions of Scope 3 activities and comprehensively covers activities in the value chain. Each category represents different types of activities that contribute to a company's overall carbon footprint. Each category consists of multiple Scope 3 activities not only one.

Category 1: Purchased goods and services are cradle-to-gate emissions (the reporting company being the gate) of all purchased goods and services otherwise not included in other upstream Scope 3 categories (Category 2 to Category 8). It simply covers all emissions that occur in the creation of the purchased product until it reaches the company’s premises. The most typical emission sources are:

- Extraction of raw materials that is used to manufacture the purchased good

- Manufacturing the product

- Transportation of materials between suppliers

- Electricity generation for supplying these activities

For and oil E&P company typical goods and services that are relevant for this category are; chemicals, sub-contracted drilling operations including well services such as P&A, wireline operations and similar, and sub-contracted offshore supply vessels for field development and operative purposes.

Drilling and field development activities usually make up a big part of supply chain emissions as they are very energy intensive. Drilling emissions are captured under Scope 3 only if drilling is not carried via own equipment (equipment owned or operated), otherwise drilling emissions are Scope 1. Please not that emissions from the construction of drilling rig that is rented is not relevant for Category 1 (or Category 2). Such emissions are only relevant for the company’s Scope 3 inventory if the rig is purchased by the company.

Category 2: Capital goods are cradle-to-gate emissions of purchased durable goods such as buildings, machines and vehicles. Category 2 is often reported together with Category 1 as company’s internal financial accounting systems do not distinguish those goods.

For and oil E&P company typical goods and services that are relevant for this category are; steel and cement used in construction of oil fields, gas turbines, water and oil pumps, and pipelines.

Category 3: Fuel- and Energy-Related Activities Not Included in Scope 1 or Scope 2 involves emissions related to the production of purchased fuel and energy that are not already included in Scope 1 or Scope 2.

For example, emissions from the extraction and production of purchased diesel is Category 3, however emissions from combustion of purchased diesel is Scope 1.

This category covers upstream emissions (extraction, production, and transportation) of purchased fuel, electricity, steam, heating and cooling as well as energy sold to end-users (energy retailers), also transmission and distribution losses and combustion emissions of energy sold to end users (energy retailers).

Category 4: Upstream Transportation and Distribution involves transportation and distribution emissions in vehicles and facilities not owned or controlled by the company and covers transportation and distribution of

- purchased products between Tier 1 supplier and the company (does not include transport and distribution emission between suppliers (e.g between Tier 1 and Tier 2 suppliers), which then is Category 1)

- purchased products if transport and distribution is paid by the company

- sold products between end-users or intermediate users and the reporting company if transport and distribution is paid by the company (does not include transport and distribution that is not paid by the company, which then is Category 9)

- goods between a company’s own facilities if transport and distribution is paid by the company

It includes all modes of transport; rail, sea, road and air transport.

Transport and distribution emissions from leased vehicles and facilities are Category 8 if they are operated by the company.

Category 5: Waste generated in operations involves waste treatment emissions, generated during the treatment of waste generated by the company, from waste treatment facilities that are not owned or controlled by the company. Both solid waste and wastewater is included.

Typical activities are disposal on landfills, incineration, composting, MSW etc.

If waste is incinerated without energy recovery then combustion emissions are to be reported from here. However, no combustion emissions are to be reported from Category 5 if waste is incinerated with energy recovery. In this case consumers of the energy generated from waste should account for the combustion emissions.

Collected waste is not always necessarily treated right away. In such cases future waste treatment emissions should be accounted for.

Category 6: Business travel involves transportation emissions due to employee business trips from vehicles not owned or controlled by the company. For example, emissions from airplanes, trains, buses, rental cars etc.

Category 7: Employee commuting involves emissions from transportation of employees to and from their homes from and to work in vehicles not owned or controlled by the company, such as emissions from public transport, employee owned cars and similar.

Helicopter transport of offshore staff to/from offshore oil fields does also fall into this category.

Category 8: Upstream leased assets concern only companies that have leased assets from lessors and operate them and covers operational emissions from leased assets that are not already included in Scope 1 or Scope 2.

The chosen consolidation approach defines which scope or category emissions from operated leased assets fall into.

- If the company uses operational control then emissions from leased operated assets such as leased cars are Scope 1 if vehicle has an combustion engine and Scope 2 if it is an electrical vehicle.

- If the company uses equity share approach then emissions from the combustion of fuel in vehicles engine or emissions from the generation of electricity the car uses is Category 8.

So far, we have discussed the upstream Scope 3 activities (Category 1 to Category 8). Now we will define downstream Scope 3 activities (Category 9 to 15), Scope 3 activities that occur subsequent to product sale by the company.

Category 9: Downstream transportation and distribution includes transport, distribution, storage and retail emissions of sold products between the end-user/intermediate user and the company in vehicles and facilities not owned or controlled by the company, only if the transport and distribution service is not paid by the company.

The direction of money transfer is very important here. If the company pays for this distribution service itself, then these emissions are accounted as upstream emissions and should be reported as Category 4.

All modes of transport are relevant (air, marine, road, rail). For retail companies, transport of customers to and from retail stores often is a significant contributor to the GHG emissions and therefore the Scope 3 standard recommends including those in this category.

Category 10: Processing of sold products includes emissions from the processing of sold product by third parties, in facilities not owned or controlled by the company. This category should also include such emissions if the processing takes place in future.

For example an E&P company should report emissions generated during plastic production from petroleum products in this category. However, it is usually very difficult for oil companies to chase where their barrel of crude oil is eventually used, therefore we recommend to use regional statistical data on this.

Category 11: Use of sold products covers emissions generated by end users during the use of the sold product (good and services). Thinking that the rapid accumulation of GHG emissions in the atmosphere after the industrial evolution is mainly due to combustion of fossil fuels, makes this category particularly important. The true impact of companies that extract and sell fossil fuels is captured here.

Total expected lifetime emissions of sold product should be reported. For example, if the sold product is an electric appliance, emissions from the generation of electricity consumed from the day the end user starts using the product until product disposal is to be reported. For durable products this will correspond to many years of electricity consumption.

Category 12: End-of-life treatment of sold products includes emissions generated during the waste treatment of sold products at their end-of-life. It covers similar activities that were described for Category 5 (Waste generated in operations), such as incineration, recycling, landfill disposal. Product disposal of durable sold products occur in future, and the inventory should include future waste treatment emissions.

Category 13: Downstream leased asset is only relevant for companies that lease assets to other companies (acting as lessor/receivers of payment from lessees). It is not relevant for companies that lease assets from other companies (acting as lessee).

This category includes emissions generated from the use of leased assets owned and leased out by the company if not already included in Scope 1 and Scope 2. The chosen consolidation approach and the type of leasing arrangement (finance lease or operating lease) affects if emissions fall into this category or Scope 1 and Scope 2.

Category 14: Franchises is relevant both for companies that grant licenses to other companies to sell or distribute its products (franchisors) and for companies that operate under a license to sell and distribute another company’s products (franchisees). This category covers emissions from the operation of franchises not included in Scope 1 and Scope 2.

Category 15: Investments covers emissions from the operation of investments, not already included in Scope 1 and Scope 2. Chosen consolidation approach affects these emissions. For example, when an E&P company chooses equity share approach then emissions from investments are Scope 1 or Scope 2. When an operational control approach is chosen then emissions from investments are Scope 3 Category 15.

Now that we have described the famous 15 Scope 3 categories, we can easily conclude that minimum activity boundaries and time boundaries of these categories differ. The Scope 3 standard requires reporting cradle-to-gate emissions for some categories and operational emissions for some categories. The standard also requires including past emissions or future emissions for some categories in addition to emissions generated in the reporting year. The table below summarizes the minimum boundary and time boundary for every Scope 3 category, ref. Scope 3 standard.

Table 1: Scope 3 minimum boundaries and time boundary

|

Category |

Minimum boundary |

Time boundary |

|

Category 1 |

All upstream (cradle-to-gate) emissions of purchased goods and services |

Past years and reporting year |

|

Category 2 |

All upstream (cradle-to-gate) emissions of purchased capital goods |

Past years and reporting year |

|

Category 3 |

a. For upstream emissions of purchased fuels: All upstream (cradle-to-gate) emissions of purchased fuels (from raw material extraction up to the point of, but excluding combustion) b. For upstream emissions of purchased electricity: All upstream (cradle-to-gate) emissions of purchased fuels (from raw material extraction up to the point of, but excluding, combustion by a power generator) c. For T&D losses: All upstream (cradle-to-gate) emissions of energy consumed in a T&D system, including emissions from combustion d. For generation of purchased electricity that is sold to end users: Emissions from the generation of purchased energy |

Past years and reporting year |

|

Category 4 |

The scope 1 and scope 2 emissions of transportation and distribution providers that occur during use of vehicles and facilities (e.g., from energy use) • Optional: The life cycle emissions associated with manufacturing vehicles, facilities, or infrastructure |

Past years and reporting year |

|

Category 5 |

The scope 1 and scope 2 emissions of waste management suppliers that occur during disposal or treatment • Optional: Emissions from transportation of waste |

Reporting year and future years |

|

Category 6 |

The scope 1 and scope 2 emissions of transportation carriers that occur during use of vehicles (e.g., from energy use) • Optional: The life cycle emissions associated with manufacturing vehicles or infrastructure |

Reporting year |

|

Category 7 |

The scope 1 and scope 2 emissions of employees and transportation providers that occur during use of vehicles (e.g., from energy use) • Optional: Emissions from employee teleworking |

Reporting year |

|

Category 8 |

The scope 1 and scope 2 emissions of lessors that occur during the reporting company’s operation of leased assets (e.g., from energy use) • Optional: The life cycle emissions associated with manufacturing or constructing leased assets |

Reporting year |

|

Category 9 |

The scope 1 and scope 2 emissions of transportation providers, distributors, and retailers that occur during use of vehicles and facilities (e.g., from energy use) • Optional: The life cycle emissions associated with manufacturing vehicles, facilities, or infrastructure |

Reporting year and future years |

|

Category 10 |

The scope 1 and scope 2 emissions of downstream companies that occur during processing (e.g., from energy use) |

Reporting year and future years |

|

Category 11 |

The direct use-phase emissions of sold products over their expected lifetime (i.e., the scope 1 and scope 2 emissions of end users that occur from the use of: products that directly consume energy (fuels or electricity) during use; fuels and feedstocks; and GHGs and products that contain or form GHGs that are emitted during use) • Optional: The indirect use-phase emissions of sold products over their expected lifetime (i.e., emissions from the use of products that indirectly consume energy (fuels or electricity) during use) |

Reporting year and future years |

|

Category 12 |

The scope 1 and scope 2 emissions of waste management companies that occur during disposal or treatment of sold products |

Reporting year and future years |

|

Category 13 |

The scope 1 and scope 2 emissions of lessees that occur during operation of leased assets (e.g., from energy use). • Optional: The life cycle emissions associated with manufacturing or constructing leased assets |

Reporting year |

|

Category 14 |

The scope 1 and scope 2 emissions of franchisees that occur during operation of franchises (e.g., from energy use) • Optional: The life cycle emissions associated with manufacturing or constructing franchises |

Reporting year |

|

Category 15 |

Operation of investments (including equity and debt investments and project finance) in the reporting year, not included in scope 1 or scope 2 |

Reporting year and future years |

After reviewing the Scope 3 activities (categories) the company will have a good overview of all activities in the value chain that a Scope 3 inventory is expected to include. The next step will be mapping their own value chain, where a complete list of activities in the company’s value chain is created. (In addition, a list of purchased goods and products, a list of sold product and services and a list of value chain partners should be created). It is expected that this list includes all activities described in the Scope 3 categories, and that any exclusions are justified. However, aiming for a 100% completeness is not feasible either, since not all activities are material for a Scope 3 study or relevant for a company’s operations. This list should be representative of a company’s value chain activities, it should not be exhaustive where resources are exhaustively used for very little gain in return. But how do we know which activities to prioritize, and which activities are most relevant?

The size of emissions is a very important criterion to bear in mind when creating the value chain activity list in accordance with the Scope 3 standard. The inventory will be vastly compromised if activities with very big emissions impact are missed. The Scope 3 standard is interested in the emissions of the following gases: Carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulphur hexafluoride (SF6) emissions. Only, CO2 emissions from the combustion or biodegradation of biomass are out of scope.

It is not always very straightforward or clear for the companies to know which activities have high GHG impact. It is recommended to carry out an emissions screening with calculation methods that are quick and easy, in order to roughly estimate emissions and to identify hot spots. Environmentally-extended input output EEIE models are most commonly used for emissions screening, however proxy data or industry averages can also be used.

The company may have a stronger influence in reducing emissions from some value chain activities, and such activities should be prioritized. Upstream activities are usually easier to influence.

Activities in the value chain that are in-line with the defined business goals should also be prioritized. For example, if the business goal is to manage risks then activities that contribute to a company’s risk exposure are very relevant. If the business goal is to respond to stakeholder expectations then activities that are deemed critical for the stakeholders are very relevant.

It would also be smart to review sector guidance when available, in order to capture activities that are already identified as significant. Outsourcing is also deemed as a criterion by the Scope 3 standard in reviewing the relevance of a value chain activity.

In this chapter we have described value chain activities that a Scope 3 inventory should include and discussed how to set the Scope 3 boundary. We have also discussed how to create a company’s own value chain activity list in-line with the Scope 3 standard. Once this activity list is created it is time for collecting data. In our next issue we will discuss how to collect Scope 3 data.